tax avoidance vs tax evasion hmrc

People can give HMRC a call to report tax fraud and tax evasion. Tax evasion on the other hand is using illegal means to.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax evaders are bad for the economy and are generally sticking their fingers up at society.

. A taxpayer charged with tax evasion could be convicted of a felony and be. The difference between tax avoidance and tax evasion essentially comes down to legality. You can also report it online or write to HMRC at Cardiff CF14 5ZN.

It could be argued that in the case of evasion the government was entitled to the tax whereas in cases of avoidance it will either receive the tax due - if the avoidance fails - or it was never entitled to it - if the avoidance succeeds. You can report tax avoidance to HMRC by contacting the HMRC hotline or completing the online reporting form if you. If youve gone a step further and are deemed to be engaging in aggressive tax avoidance that HMRC doesnt agree with you could be investigated and potentially pay the tax back but it is a murky area at times.

Many tax avoidance schemes that are devised by accountants and marketed towards the rich and wealthy have been heavily criticised and in some cases shut down by HM Revenue Customs HMRC as they argue that these schemes actually amount to tax evasion. How Can I Tell the Difference. The tax evasion vs tax avoidance debate is a long-standing one.

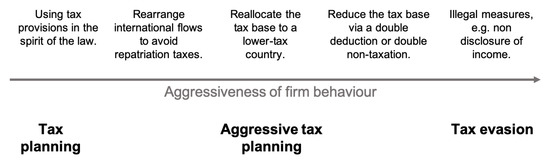

Tax evasion means concealing income or information from the HMRC and its illegal. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. Unlike tax avoidance tax planning is the practice of minimising tax liability with no.

Fined up to 100000 or 500000 for a corporation. Tax evasion is when you use illegal practices to avoid paying tax. This could include not reporting all of your income not filing a tax return hiding taxable.

Genuine mistakes on a tax return such as misculautions and missed deadlines can also be considered tax avoidance. Tax Evasion refers to the adoption of illegal methods for reducing liability of payment of taxes such as manipulation of business accounts understating of incomes or overstating of expenses etc whereas Tax Avoidance is the legal way to reduce the tax liability by following the methods that are allowed in the income tax laws of. Or both and be responsible for prosecution costs.

In fact HMRC you should be making tax clearer and simpler so that avoidance is easier and fairer for all. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law. Its the Al Capone path to financial freedom.

There is a fine line between avoidance and evasion. Tax avoidance is legal up to the grey area of aggressive tax avoidance. Some informants are rewarded and according to a post published by Financial Times in the 2017-2018 tax year there were.

There is a clear distinction between the two. How to report tax avoidance. Imprisoned for up to five years.

And as best I can tell it remains the case that tax avoidance is not illegal. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two reports one. It is sometimes difficult to appreciate the difference between the two but in basic terms tax evasion is deliberately escaping from paying tax that should be paid whereas tax avoidance is the exploitation of rules in order to reduce the tax that would otherwise be paid.

Tax evasion means doing illegal things to avoid paying taxes. Tax avoidance involves using whatever legal means you choose to reduce your current or future tax liabilities. Tax avoidance promotes tax saving and many corporates and legal professionals support.

On the other hand tax evasion involves deliberately withholding or. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe. Have been encouraged to get into a tax avoidance scheme.

Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down on what it suspects to be tax avoidance - and you dont need to look far to find examples of these stories in national newspapers. Tax avoidance means using the legal means available to you to reduce your tax burden. Tax planning either reduces it or does not increase your tax risk.

We have gathered examples from recent and historic high-profile cases to help you unpick the fine line between tax avoidance and tax evasion. Avoiding tax is legal but it is easy for the former to become the latter. HMRC defines tax avoidance as The moulding and contriving of rules according to ones interest to avoid or mitigate tax liability.

The numbers are 0800 788 887 UK and 0203 080 0871 outside the UK. Its not always easy to see where one ends and the other begins. In its simplest form many people can practice tax evasion.

Famous Tax Evasion Penalties. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. Tax Avoidance is the lawful use of rules to mitigate tax liabilities leading to reduced tax payments.

Crossing that line can lead to hefty fines and prosecution. An Individual Savings Account ISA is a legal way to avoid paying income taxes since all savings in an ISA are tax-free. Tax Evasion Understatingconcealing income or overstatingfabricating expenses would be classed as tax evasion.

It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. Heavy Tax Avoidance Offshore corporations and specifically designed tax avoidance schemes would usually fall into this category. Difference Between Tax Evasion and Tax Avoidance.

There are a number of penalties that authorities could apply such as a failure to file penalty or an underpayment penalty.

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

National Insurance Company Jobs In 2021 National Insurance Company Job Insurance Company

Differences Between Tax Evasion Tax Avoidance And Tax Planning

John Wade On Twitter Read It And Weep Social Awareness Graphing

Epsu Expresses Solidarity With Tax Inspectors And Pcs Union As Uk Government Paves Way For Tax Avoidance Epsu

What Is Tax Avoidance Differences Between Tax Avoidance Tax Evasion

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Avoidance Vs Tax Evasion What S The Difference

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Difference Between Tax Evasion Avoidance Planning

Lowtax Global Tax Business Portal Tax Cartoons Lawyer Jokes Accounting Humor Accounting Jokes

The Charity Commission Is To Focus On Compliance By Charity Legal Obligations Rigour Which It Holds Charities Accounting Services Wales England Sample Resume

Letter To Tax Office Inland Revenue Department Reporting On Tax Evasion Docpro

Differences Between Tax Evasion Tax Avoidance And Tax Planning